10 Most Powerful Bitcoin Quotes That Will Blow Your Mind

If there’s one voice in crypto that cuts through the noise, it’s Michael Saylor. Love him or not, the guy bet MicroStrategy—and his personal wealth—on Bitcoin. And every time he talks, real investors listen.

Here are his top 10 Bitcoinquotes that changed the way I think about money, time, and the power of holding.

#1: “Bitcoin is digital property. It’s better than gold, better than real estate, better than everything that came before it.”

This one hit me hard.

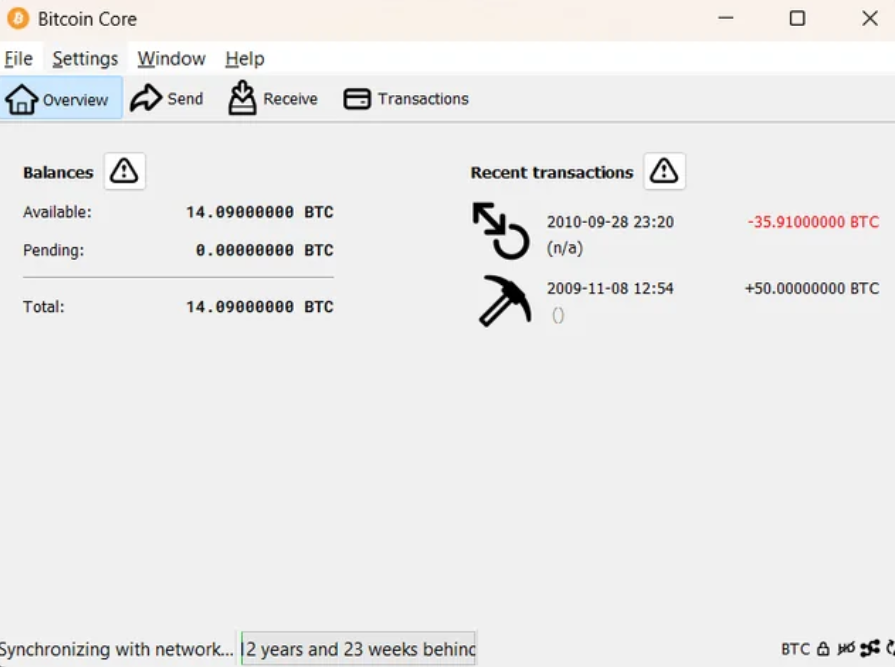

I remember back in 2010, I was messing around on the internet when my mum came over to me and said, “Hey Enzo, what’s that Bitcoin thing?” I laughed it off, thinking to myself, “Lol, it’s impossible—anonymous? Shady. Probably a virus. Besides, I’m sure it’s hackable or easy to copy-paste. You can’t make digital money” So, I didn’t take it seriously. I ended up formatting the disk where I had some early Bitcoin files stored. Fast forward to 2013, when Bitcoin started gaining traction, I deeply regretted making that decision.

That quote from Saylor reminded me of what I dismissed… and what I lost. And that’s exactly why I hold now—and teach others to avoid my mistakes.

#2: “You should be acquiring Bitcoin every single day. Dollar-cost average. Relentlessly.”

Saylor isn’t just about buying big. He’s about buying smart—consistently.

Even now, I DCA into BTC every week using KuCoin. No emotion. No guessing the bottom. Just accumulation. If I had done this back in 2013 instead of selling at $1,000, I’d be somewhere else entirely. But hey—lessons learned, right?

Don’t try to time the market. Just accumulate, automate, and forget about it.

Open a KuCoin account and start DCA’ing today

(Use this link for a trading bonus)

#3: “If you have Bitcoin, never sell it. Never trade it. Never lend it. Just hold it for a decade.”

This is the mindset shift.

We’re not here to flip coins. We’re here to build generational wealth. Bitcoin is not a get-rich-quick scheme. It’s a get-free-slowly revolution.

I’ve been through every stage:

- Holding

- Selling early

- Panic-trading

- Even trying to mine altcoins

I keep a chunk of BTC on KuCoin for flexibility, but nothing beats the peace of knowing my long-term Bitcoin is locked in cold storage—untouchable for at least 10 years.

#4: “Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy.”

This quote sounds poetic, but it’s a powerful metaphor for Bitcoin’s resilience and growth.

Saylor is describing Bitcoin as a decentralized, unstoppable force—protected by cryptography and fueled by its community’s belief in its truth as a store of value. I remember when I first got into crypto, I underestimated the power of Bitcoin’s network. I chased altcoins, thinking they’d outpace BTC. But watching Bitcoin survive every attack, every FUD, and every bear market made me realize Saylor’s right—it’s a swarm that keeps getting stronger.

If you’re new to crypto, don’t get distracted by shiny new tokens. Focus on Bitcoin’s fundamentals and its unyielding growth over time.

#5: “Bitcoin is a bank in cyberspace, run by incorruptible software, offering a global, affordable, simple and secure savings account to billions of people that don’t have the option or desire to run their own hedge fund.”

Saylor nails the accessibility of Bitcoin here.

I’ve met people who don’t trust banks—or can’t access them. In 2015, I traveled to a country where inflation was eating savings alive. People there couldn’t afford to invest in complex financial products, but they could buy a fraction of a Bitcoin. Saylor’s vision of Bitcoin as a “bank in cyberspace” resonates with me because I’ve seen how it empowers people who are left out of traditional finance.

If you’re skeptical about Bitcoin, think about its potential to bank the unbanked. It’s not just an investment—it’s a lifeline for billions.

#6: “All my best investments were in networks that everyone needed, no one could stop, and few understood. Bitcoin is the monetary network.”

This quote made me rethink what makes a good investment.

I used to chase trends—altcoins, ICOs, you name it. But Saylor’s focus on unstoppable networks hit home. Bitcoin isn’t just a coin; it’s a global monetary system that’s been running without fail since 2009. I wish I had understood this earlier instead of jumping into projects that sounded cool but lacked staying power. Bitcoin’s network effect—its growing user base and security—makes it a no-brainer for long-term investors.

Look for investments that are essential and resilient. Bitcoin fits that bill perfectly.

#7: “The signal is monetary expansion everywhere. The problem is people are going to lose half their wealth in a few years. The solution is Bitcoin. The rest is noise.”

Saylor’s warning about inflation is a wake-up call.

I’ve seen the effects of monetary expansion firsthand. In 2020, I watched my savings lose value as governments printed money like there was no tomorrow. Saylor’s point is that fiat currencies are devaluing, and Bitcoin is the hedge. I started moving more of my wealth into BTC after hearing this, and it’s been a game-changer. While others panic about inflation, I sleep better knowing my Bitcoin is a shield against it.

If you’re worried about your savings losing value, consider Bitcoin as a solution. It’s a hedge against the “noise” of traditional finance.

#8: “Bitcoin is the first software network capable of storing all the monetary energy in the world with no loss of power over time and negligible transmission loss. Assuming broad adoption, that would make it the most valuable invention of the modern era. Few understand this.”

This quote highlights Bitcoin’s technical brilliance.

I used to think Bitcoin was just “digital gold,” but Saylor’s description of it as a software network that stores “monetary energy” opened my eyes. It’s a system that doesn’t degrade over time—unlike fiat money, which loses value through inflation. I regret not diving deeper into Bitcoin’s tech earlier. If I had, I might have held onto those 150 BTC I mined instead of losing them to a forgotten wallet.

Bitcoin’s ability to preserve value over time is what makes it revolutionary. If you’re not in yet, you’re missing out on what could be the most valuable invention of our era.

#9: “The destiny of money is to be encrypted.”

Short, but profound.

Saylor’s vision of the future is clear: money will be digital and secure. I’ve seen how traditional finance fails—hacks, fraud, and middlemen taking their cut. Bitcoin’s encryption makes it a fortress. I learned this the hard way when I lost money to a shady exchange in 2014. Now, I only trust decentralized systems like Bitcoin, where my funds are secured by math, not promises.

The future of money is encrypted, and Bitcoin is leading the way. Make sure your wealth is part of that future.

#10: “Bitcoin is the dominant digital monetary network. The next billion members will pay trillions to join. You might want to join first.”

This quote is a call to action.

Saylor’s prediction about Bitcoin’s growth is bold, but it makes sense. I’ve watched Bitcoin’s adoption explode over the years—from a niche experiment to institutions like MicroStrategy buying in. I wish I had acted sooner, back when BTC was under $1,000. Now, with more people joining the network, the cost of entry keeps rising. Saylor’s right: the next billion users will drive Bitcoin’s value even higher.

Don’t wait for the crowd. Join the Bitcoin network now, before it costs trillions to get in.

Start your Bitcoin journey with KuCoin today (Use this link for a trading bonus)

Final Thoughts

If I had understood these quotes back in 2010, things would be very different. Saylor’s insights have taught me to focus on Bitcoin’s fundamentals, ignore the noise, and build wealth for the long term. Whether you’re new to crypto or a seasoned investor, his words are a roadmap for navigating this revolution. Hold, DCA, and never sell—because Bitcoin isn’t just money; it’s the future.

If you’re a small trader like me, sniper trading low-cap gems can be a game changer. One of my top picks is Bloktopia—low market cap, high potential. Check out this post in BlokInvestor to see why it’s perfect for targeted trades!

Disclaimer: The content on this post is for informational purposes only and should not be considered as financial or investment advice. Always do your own research and consult with a financial advisor before making investment decisions.

Disclaimer: The content on this website is for informational and educational purposes only and should not be considered financial, investment, or legal advice. We are not financial advisors, and the opinions expressed here are not a substitute for professional financial guidance. Cryptocurrency investments carry significant risks, including the potential for financial loss. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We are not responsible for any financial losses or damages resulting from the use of the information provided on this site. This post contains affiliate links and we may earn a commission if you sign up, at no extra cost to you.

Post Comment