Bitcoin Breakout to $120K in Sight as Markets Grapple with Fed’s Hawkish Stance

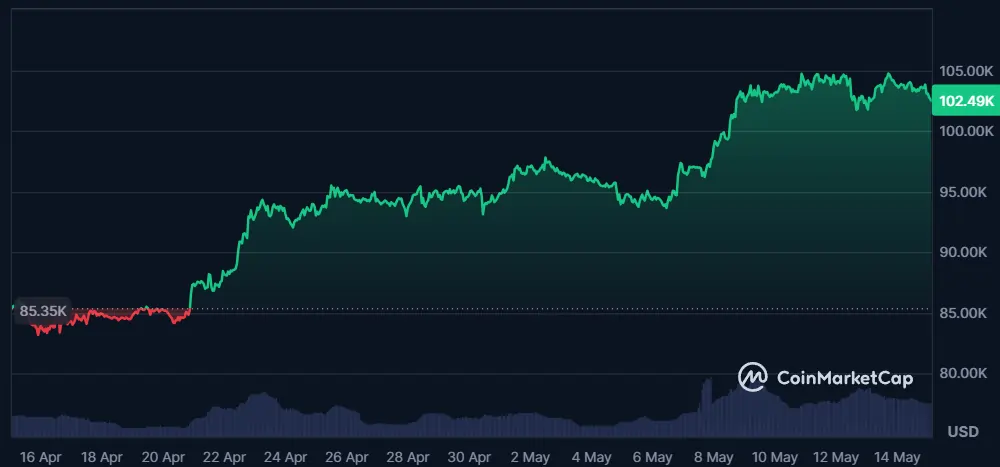

Bitcoin is hovering around $103,000, teasing traders with a potential breakout, while macroeconomic headwinds keep risk assets on edge. As the Federal Reserve maintains its hawkish stance, the crypto market is bracing for volatility. A Bitcoin breakout to $120K is now a key narrative dominating both retail and institutional sentiment, driven by speculation, momentum, and tightening supply dynamics.

Traders are eyeing short-term gains and a potential push toward the $120,000 level, but on-chain metrics are flashing warning signs reminiscent of the 2021 double-top cycle. With open interest surging and funding rates heating up, the question isn’t if Bitcoin will break out — it’s whether this rally has enough fuel to avoid becoming another bull trap.

Bitcoin’s Consolidation: A Prelude to Upside?

At the Wall Street open on May 14, Bitcoin (BTC) was trading near $103,493, according to Cointelegraph Markets Pro and TradingView.

After briefly touching $105,000, BTC has lost momentum — yet traders remain bullish.

“Even though $BTC looks great IMO, I still stand by the fact that it probably moves sideways from here for a while, which would probably be great news for alts tbh,”

— Byzantine Trader on X

Roman, another popular trader, added that consolidation often signals continuation, stating that if BTC holds its ground, a break above $108K could open the doors to $120K.

Fed’s Hawkish Policy Clouds Rate Cut Hopes

Despite a cooler-than-expected CPI print on May 13, Bitcoin couldn’t ignite a fresh rally.

Now, all eyes are on the PPI data (May 15) — a potential catalyst for risk assets.

Trading firm QCP Capital explained:

“US CPI came in below expectations, providing a welcome reprieve to inflation worries and bolstering bets on rate cuts.”

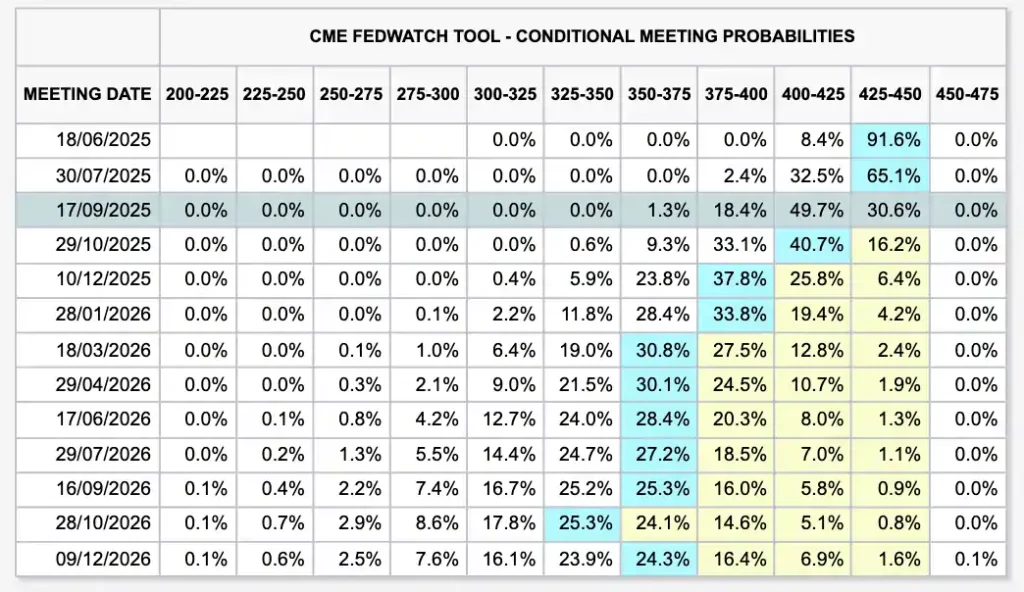

However, the Federal Reserve’s hawkish tone has crushed hopes of an imminent pivot. According to the CME FedWatch Tool, the earliest likely window for a rate cut is September 2025, and market expectations have adjusted from 4 cuts to just 2 in 2025.

Echoes of 2021: Is a Double Top Looming?

While short-term traders are focused on the $120K target, on-chain metrics are sounding familiar alarms:

- RSI Bearish Divergence: Three lower highs in RSI since March 2024, despite price increases

- Declining Volume: CME Bitcoin futures volume has not matched January’s bullish surge

- Open Interest Down: Dropped 13% since January peak

These signs mirror the 2021 cycle, when Bitcoin peaked at $65K, dipped hard, then bounced to $69K — forming a classic double top before the market crashed into a year-long bear phase.

Bitcoin Breakout to $120K

The landscape today isn’t the same as 2021:

- Institutional adoption has grown

- Spot Bitcoin ETFs bring in traditional investors

- BTC has distanced itself from centralized collapses (like FTX)

But… new risks are forming:

- MicroStrategy’s leveraged Bitcoin bet

- $6.3B DeFi Bitcoin ecosystem

- Memecoin mania creating unstable liquidity pockets

- Possible “sell the news” reactions if big announcements drop

All of these could intensify downside risk in case of a correction.

What’s Next for Bitcoin?

The key level to watch is $108,000. If BTC breaks above, it could quickly rally to $120K.

But let’s be real:

The Fed’s tone, declining volume, and RSI divergence are not to be ignored.

There’s opportunity here — but also serious risk.

As Byzantine Trader suggested, altcoins may shine while Bitcoin consolidates. Still, investors should proceed with caution and learn from 2021’s trap.

Stay Updated

We’ll keep covering breaking Bitcoin news and market insights — not just affiliate pieces. Expect more updates like this daily on BlokInvestor.

If you want to discover some promising altcoins to watch, check out our post on the 10 most promising altcoins right now. Also, don’t miss our deep dive into the recent Coinbase hack and why having a hardware wallet is crucial for protecting your crypto.

We’ll keep covering breaking Bitcoin news and market insights — not just affiliate pieces. Expect more updates like this daily on BlokInvestor.

Disclaimer: The content on this website is for informational and educational purposes only and should not be considered financial, investment, or legal advice. We are not financial advisors, and the opinions expressed here are not a substitute for professional financial guidance. Cryptocurrency investments carry significant risks, including the potential for financial loss. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We are not responsible for any financial losses or damages resulting from the use of the information provided on this site. This post contains affiliate links and we may earn a commission if you sign up, at no extra cost to you.

Post Comment