Top 3 DeFi Protocols Paying Users in 2025: Real Yield is Back

The DeFi landscape in 2025 is evolving fast, and the spotlight is back on DeFi protocols delivering real yield — sustainable returns powered by actual protocol revenue, not token inflation.

From Solana to Base and Ethereum, these top DeFi protocols are rewarding users through lending fees, revenue sharing, and optimized liquidity strategies. Let’s break down the three leaders redefining passive income this year.

1. Kamino Finance (Solana) – The Yield Powerhouse

- Ticker: KMNO ($0.05, $130.7M market cap, $292M fully diluted)

- Protocol Type: Lending + Automated Liquidity Provision

Real Yield Mechanism

Kamino Finance is Solana’s go-to for lending and concentrated liquidity management. It earns yield through:

- Lending and borrowing fees

- LP incentives on DEXs like Orca and Raydium

- Revenue-sharing via KMNO token staking

Its automated vaults dynamically rebalance to optimize yield and reduce impermanent loss.

Average APY

- 8–12% for lending vaults

- Up to 15% for leveraged LP strategies (market-dependent)

Why It’s Hot

- TVL: $482M+

- Launch of Kamino Lend V2 with peer-to-peer lending + RWA support

- Integrated tightly into Solana’s growing DeFi stack

- KMNO staking = protocol revenue + governance

Kamino’s mix of automation, strong yields, and Solana-native speed makes it one of the most compelling DeFi plays of 2025.

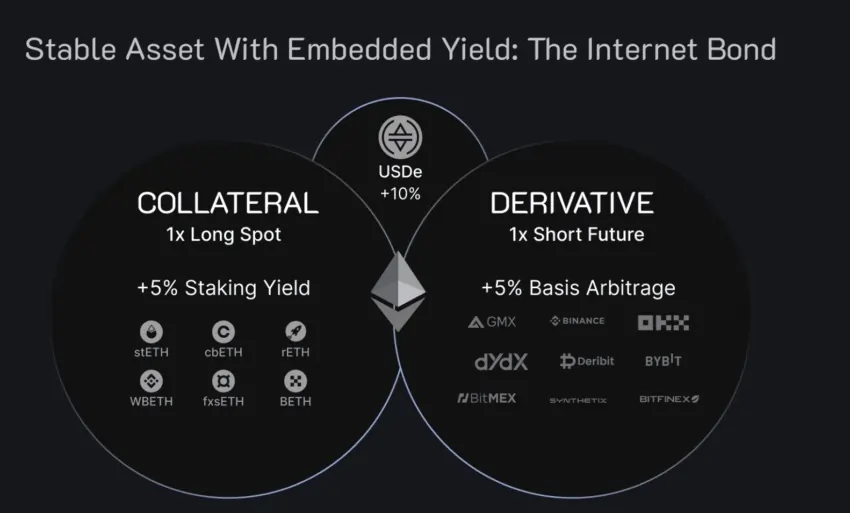

2. Ethena Labs (Base) – Stablecoin Yield Redefined

- Ticker: ENA ($0.25, $1.6B market cap)

- Protocol Type: Yield Farming / Stablecoin Staking

Real Yield Mechanism

Ethena introduces sUSDe staking, earning users yield via:

- Basis trading

- Funding rate arbitrage

- Protocol revenue — not inflationary emissions

It’s optimized for low-volatility, real yield — perfect for conservative DeFi players.

Average APY

- 15–25% for sUSDe staking

Why It’s Hot

- Exploding TVL on Base, thanks to low fees + scalable infra

- Trusted by institutions + whales

- Multiple new pools + cross-chain integration

- ENA demand grows as utility expands

Ethena is redefining what stablecoin yield can be. For passive income with solid security, this one’s hard to ignore.

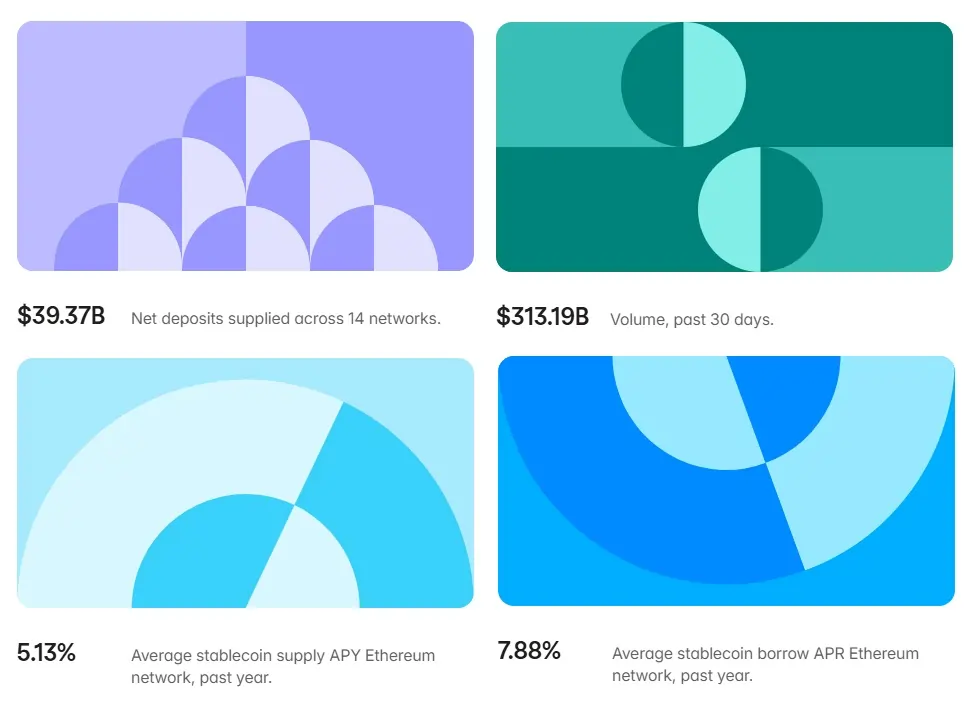

3. Aave – The Lending King

- Ticker: AAVE ($274, $4.1B market cap)

- Protocol Type: Lending

Real Yield Mechanism

Aave generates real yield from:

- Lending interest spreads

- Flash loan fees

- Zero reliance on emissions

It’s optimized for safety, capital efficiency, and protocol longevity — a true OG in the DeFi space.

🔹Average APY

- 5–10% on stablecoins like USDC

- Higher yields for ETH, wBTC, and volatile pairs

🔹 Why It’s Hot

- Arbitrum TVL surging as gas costs drop

- V3 upgrades: cross-chain collateral, better liquidation handling

- Whales and institutions parking large stablecoin stacks

- Battle-tested, rock-solid, reliable

If you want to park funds in a safe, high-yield place on a major L2 — Aave is still king in 2025.

Kamino vs. Ethena vs. Aave: Real Yield Showdown

As DeFi matures, not all protocols offer the same risk–reward profile. Here’s how the three strongest real yield protocols stack up in mid-2025:

Ethena (ENA) – Base Chain

- Pros:

- Solid protocol delivering 15–25% APY through market-neutral strategies (basis trading, funding rates)

- Real protocol revenue, not emissions

- TVL and institutional interest growing fasCons:

- $1.6B market cap = limited short-term upside

- Already saw major run-up → 2x–3x might still be possible, but you’re not early anymore

Kamino (KMNO) – Solana

- Pros:

- $130M market cap = high upside potential

- Appeared on CoinMarketCap May 2024 at ~$0.04

- Hit $0.25 in December 2024 → 6x in 7 months

- Back at ~$0.05 = essentially a full reset

- Solana’s rising TVL + Kamino Lend V2 = strong flywheel

- Cons:

- Smaller project → higher volatility, but that’s also where the opportunity lies

Aave V3 (AAVE) – Arbitrum

- Pros:

- Battle-tested blue-chip lender with deep liquidity

- Generates yield through interest spreads and flash loan fees

- No emissions, just usage-based revenue

- Recent upgrades (cross-chain collateral, liquidations) + growing institutional adoption

- Cons:

- $4.1B market cap = big and stable, but less explosive upside

- Best for capital preservation, not moonshots

What This Means

- KMNO is in the perfect accumulation zone

→ You’re buying at the same price as early 2024 insiders

→ Positioned to ride Solana’s next DeFi wave - ENA is solid for conservative yield, but already mid-cycle

- AAVE is a long-term hold with minimal downside, but limited upside

When to Buy?

Mid-Year Dips (July–August) = Accumulation Time

- Markets are quiet

- TradFi is distracted

- Smart money is positioning for Q4

September = Chop Zone

- Expect volatility, rate news, and fake breakouts

October–January = Potential Euphoria Phase

- Bitcoin runs first

- Then majors like ETH

- Then DeFi protocols

- Then memecoins go wild in late Q4

Final Alpha

Don’t chase pumps. You want to be early, not loud.

Buy while it’s boring. Sell when everyone’s screaming.

- Kamino (KMNO) = high upside, real yield, still early

- Ethena (ENA) = solid APY, mid-cycle

- Aave (AAVE) = stable, safe, battle-tested

Get in now — mid-2025 is where fortunes are made for Q4.

Next-Level DeFi: Want to go deeper?

If you’re into real yield and cutting-edge interoperability, you need to read about Sui. This Layer-1 is changing the DeFi game with parallel execution and blazing-fast finality.

👉 Explore Sui here — it’s not just hype, it’s architecture built for the future.

Disclaimer: The content on this website is for informational and educational purposes only and should not be considered financial, investment, or legal advice. We are not financial advisors, and the opinions expressed here are not a substitute for professional financial guidance. Cryptocurrency investments carry significant risks, including the potential for financial loss. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. We are not responsible for any financial losses or damages resulting from the use of the information provided on this site. This post contains affiliate links and we may earn a commission if you sign up, at no extra cost to you.

🔓 Alert – Payment of 0.85 BTC pending. Complete Now > https://graph.org/CLAIM-BITCOIN-07-23?hs=1630ef372e6384fed70238c62bd030a8& 🔓

oaqzg8

1 comment